Where does all the money go? Let’s start with some accounting basics.

by Alexandre Renaud and Barbara Scull

Job costing is the process of assigning costs to a specific job or project to determine if it will generate enough gross profit to cover expenses and contribute to net profit. While managers often engage in job costing after a project is over and all of the numbers are in, it is also helpful to use a job costing model when you are pricing a project. Job costing at the beginning of a project will help ensure that you don’t accept work that doesn’t contribute to your bottom line. Projects that aren’t priced high enough can actually cost you money!

Accounting basics

Let’s begin by reviewing some accounting basics, starting with a simple profit formula:

π = R – (Fc + Vc)

In this formula:

- π = Profit

- R = Revenue (sales)

- Fc = Fixed costs

- Vc = Variable costs

Here’s a simple example: For a project with revenue of $100, fixed costs of $40 (40 percent of revenue), and variable costs of $50 (50 percent of revenue), the profit is $10 (10 percent of revenue).

$10 = $100 – ($40 + $50)

Fixed costs (Fc) are invariable in totality and variable per unit. Let’s consider a business with annual fixed costs of $600,000 (invariable in totality):

- With sales of $2,000,000, fixed costs are $0.30 per dollar sold.

- With sales of $3,000,000, fixed costs are $0.20 per dollar sold.

- For 20,000 hours of direct labor, fixed costs are $30 per hour.

- For 30,000 hours of direct labor, fixed costs are $20 per hour.

To identify fixed costs, consider what it would cost to run your business if you had zero dollars in sales. What would it cost to just remain open in 2020? This could include rent, electricity and gas, administration fees, amortizations and any other costs that will not fluctuate based on sales for the year. Some employee salaries could be considered a part of your business’s fixed costs.

Variable costs (Vc) are variable in totality and invariable per unit. For example, in a business with variable costs of $55 per hour (invariable per unit or per hour of direct labor):

- With sales of $2,000,000, variable costs are $55 per hour.

- With sales of $3,000,000, variable costs are $55 per hour.

- For 20,000 hours of direct labor, variable costs are $1,100,000.

- For 30,000 hours of direct labor, variable costs are $1,650,000.

To identify variable costs, consider the expenses you incur only when providing the product or service. These costs are directly proportionate to the volume of business or sales. In other words, a variable cost is a corporate expense that changes in proportion with production output. Variable costs increase or decrease depending on a company’s production volume; they rise as production increases and fall as production decreases. Examples of variable costs are direct labor, attrition/consumables, truck and vehicle rental fees, and travel expenses.

Determining whether a cost is fixed or variable can be tricky. Is sales staff a fixed or variable cost? What about transportation/delivery? And how about warehouse staff, including warehouse time for employees who don’t go on the road? Determining which category these costs fall into requires judgment and consistency.

Before examining different approaches

to job costing, there are a few other

accounting basics to consider.

Gross profit (GP) is the difference between revenue and the cost of making a product or providing a service, before deducting overhead costs, payroll, taxes and interest payments.

GP = Revenue (R) – Variable costs (Vc)

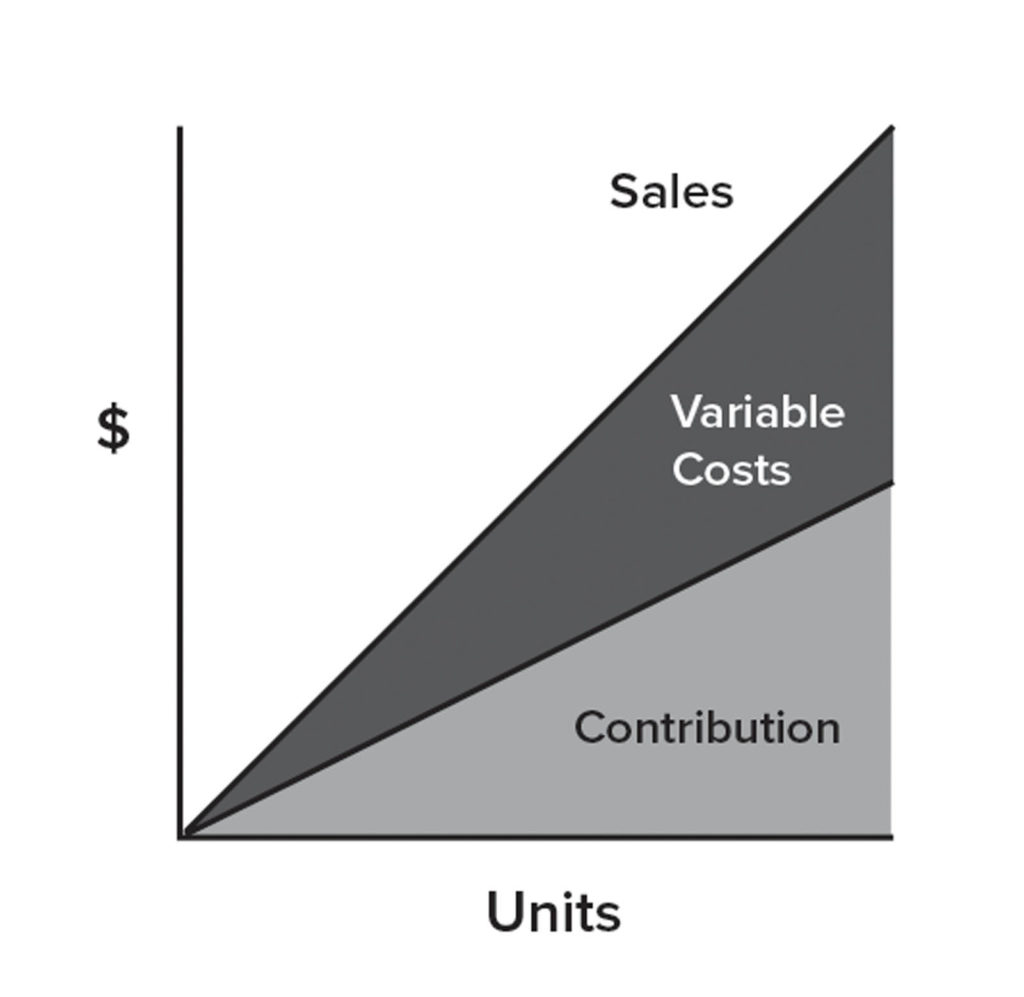

Contribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. “Contribution” represents the portion of sales revenue that is not consumed by variable costs and therefore contributes to the coverage of fixed costs. Basically, contribution margin is the money that is left over, to cover fixed costs and yield a profit, after deducting variable costs from revenue. This concept is one of the key building blocks of break-even analysis. (See Figure 1.)

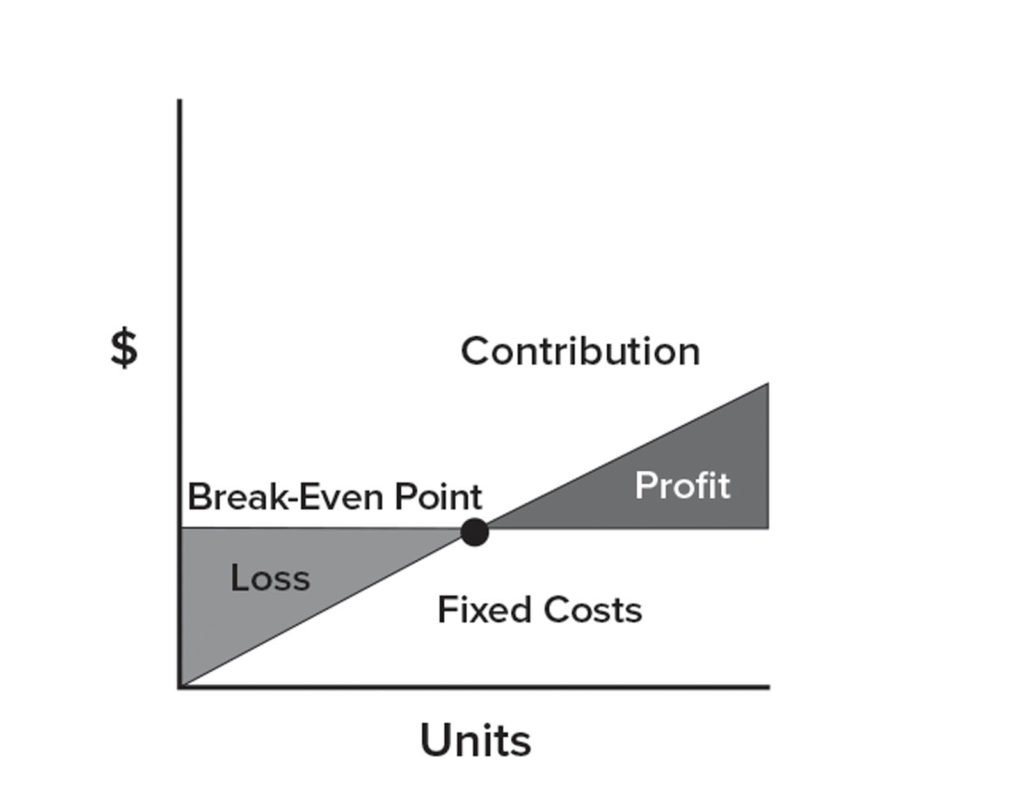

Break-even point (BEP) represents the sales amount—in either unit (quantity) or revenue (sales) terms—that is required to cover total costs; that is, both fixed and variable costs to the company. Basically, BEP is the volume of business required to cover all costs but make zero in profit. (See Figure 2.)

Why are these concepts important to job costing and decision-making with regard to your tent rental company? Knowing your average contribution margin and break-even point will allow you to determine if a particular job will contribute to your overall profitability and how aggressive you need to be on pricing to be competitive yet profitable.

Other considerations

In addition to profitability from cost analysis, there are other factors to keep in mind when you are considering whether to take on a job. Here are a few:

- Opportunity costs.

- Learning curves and increasing efficiency.

- Cash flow. Will you require a deposit and payment in full before proceeding with the project?

- Customer relationships. If the project under consideration is with an established customer, do you risk losing the customer if you don’t accept the project? If the project is with a new customer, does the customer represent an opportunity for increased sales growth?

- Installation schedule. Does the project have time restrictions on the setup and tear down, or is the schedule flexible?

- Weather. Are there weather constraints to consider with regard to the event date?

- Season. Will the installation happen in your high season or slow season? In the slow season, should you consider taking on a job with a lower contribution margin because it will contribute to cash flow? In the busy season, will you have to factor in the cost of overtime pay?

- Timeline. For example, is this project being bid on so far in advance that you don’t yet know about the jobs that will come in from regular customers during the same period?

In part 2, we’ll apply these concepts to two job costing methods.

Alexandre Renaud is international sales manager for Fiesta Tents Ltd., Saint-Laurent, Quebec, Canada. Barbara Scull, CPA, is president of The Alleen Company, Cincinnati, Ohio. Renaud and Scull led an educational session at Tent Expo 2019 on job costing for tent rental companies.

TEXTILES.ORG

TEXTILES.ORG