Where does all the money go? Let’s examine two job costing methods.

by Alexandre Renaud and Barbara Scull

In part 1 of this two-part series on job costing, we reviewed accounting basics for tent rental companies, including a basic profit formula, fixed and variable costs, gross profit, contribution margin and break-even point. Understanding these concepts and applying them to your job costing efforts before you price a job will help you determine if a specific job will contribute to your bottom line. As we noted in part 1, projects that aren’t priced high enough can actually cost you money!

Now we’ll review two methods for job costing.

Alex’s method

Alex begins job costing by determining these values:

- The volume of sales necessary for his company to hit the break-even point (BEP). This is the point at which the company will cover total costs (fixed and variable) but not make a profit.

- The estimated total hours of direct labor at BEP volume.

- His company’s total annual fixed costs (Fc). This is what it costs to run the business for a year with no sales.

- His company’s variable costs (Vc). These are costs the company incurs only when providing a product or service. Variable costs may be expressed as cost per hour of direct labor, cost per dollar of sales, cost per square footage or another basis.

Here’s an example starting with some hypothetical numbers. To accurately price a potential upcoming project, Alex determines these values:

- BEP = $3,000,000

- Estimated total hours of direct labor at a volume of $3,000,000 = 51,400 hours

- Fc = $1,200,000

- Vc at a volume of $3,000,000 = $1,800,000

In this example:

- Fixed costs per hour of direct labor is $23/hour:

$1,200,000/51,400 hours = $23/hour

- Variable costs per hour of direct labor is $35/hour:

$1,800,000/51,400 hours = $35/hour

Therefore, the average total cost per hour of direct labor (with volume based on BEP of $3,000,000) is $58/hour:

$23 + $35 = $58/hour

To estimate profit with a volume of $3,500,000 in sales:

- Additional revenue exceeding break-even point:

$3,500,000 – $3,000,000 (BEP) = $500,000

- Contribution margin based on $1,200,000 (Fc) and $3,000,000 (BEP):

Fc/BEP = $1,200,000/$3,000,000 = 40% (0.4)

- Profit is revenue multiplied by the contribution margin:

$500,000 X 0.4 = $200,000 profit

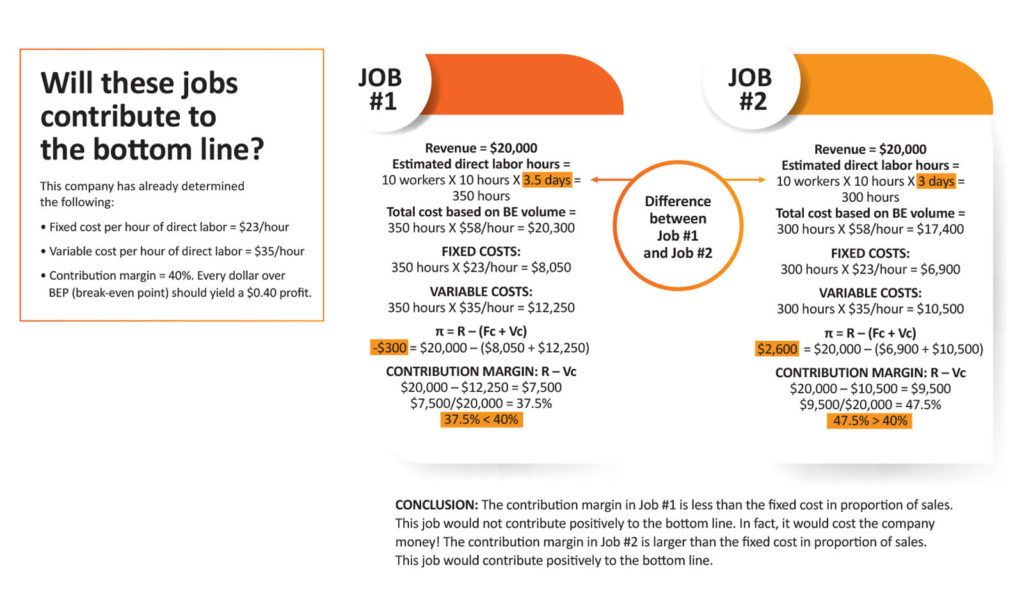

In this example, every additional dollar past BEP should yield a profit of $0.40.

See the infograph on page 46 for an application of this method to determine whether a job will contribute to the company’s bottom line.

Barbara’s method

In The Alleen Company’s market, price for tent rental is often set by competition and market rates. Accurate job costing is required to determine if a project warrants added charges. To price a project, Barbara follows this method:

1. Calculate variable costs. This includes labor (labor hours multiplied by labor costs), materials, travel (hotels, per diem, airfare), transportation (number of trucks multiplied by the average cost to operate plus fuel and ballast transportation costs), commissions associated with the project, and so on.

2. Calculate the gross profit (GP) and gross profit margin. Gross profit margin is often expressed as a percentage of revenue. The formula for gross profit margin is:

GP margin = R – Vc/R

3. Calculate annual fixed costs. These include salaries (managers, sales, warehouse and administrative, plus related payroll taxes); advertising, marketing and promotions; legal, accounting, information technology, bank fees, dues and subscriptions; insurance; depreciation; real estate taxes; and rent, maintenance, utilities and communications.

4. Using the previous year’s annual fixed costs, determine the annual gross profit needed to reach BEP. (See part 1 for more on BEP). The formula is:

BEP = fixed costs/gross profit margin

For example, if fixed costs are $1,000,000, and gross profit

margin is 60%, BEP is $1,666,666.

$1,666,666 = $1,000,000/60%

5. With the previous year’s gross profit margin percent, Barbara can determine if a specific job will generate enough gross profit to proportionally contribute to cover the break-even point.

Final thoughts

Job costing is not an exact science, and there is more than one way to approach it. What’s important is to have an understanding of your company’s job costs before pricing a project, rather than reviewing job costs after a project is complete. Many assumptions are made when calculating costs, and we recommend estimating on the high side to allow for unexpected costs.

You may have years in which you have extraordinary expenses and/or changes to annual fixed income. Also consider that the cost of living increases every year. Are you raising your prices every year? Are you reviewing your job costs at least annually?

A final decision on most projects comes down to more factors than just job costing. Review each project individually and take all factors into consideration.

Alexandre Renaud is international sales manager for Fiesta Tents Ltd., Saint-Laurent, Que., Canada. Barbara Scull, CPA, is president of The Alleen Company, Cincinnati, Ohio. Renaud and Scull led an educational session at Tent Expo 2019 on job costing for tent rental companies.

TEXTILES.ORG

TEXTILES.ORG