U.S. and world markets overview

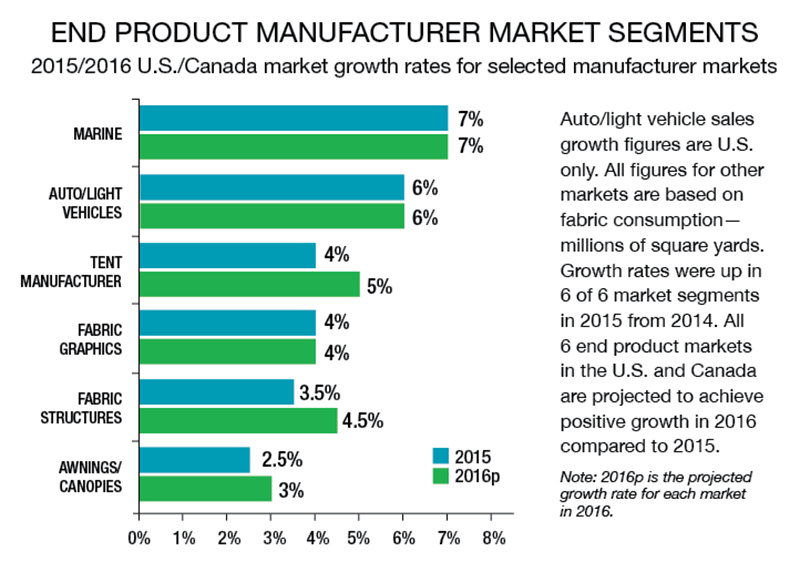

All but one of the traditional end product market segments regularly monitored by IFAI achieved single-digit sales growth in 2015. (The military market was flat in 2015.) The marine fabrics market tops the list—growing at 7 percent. Investing in state-of-the-art equipment, lean/quality improvement manufacturing practices, training staff and developing and marketing innovative products targeted to customers have helped keep these businesses in the black.

The world market for specialty fabrics grew approximately 2.4 percent in 2015 and is expected to achieve sales growth of 2.5 percent in 2016. Constraints on global growth in the specialty fabrics market in 2015 were largely attributable to a slower growth rate of 3.1 percent in worldwide GDP. The decline reflects a striking slowdown in the economies of emerging markets like China; this slowdown was offset by strong consumer spending in the United States.

The world market for specialty fabrics grew approximately 2.4 percent in 2015 and is expected to achieve sales growth of 2.5 percent in 2016. Constraints on global growth in the specialty fabrics market in 2015 were largely attributable to a slower growth rate of 3.1 percent in worldwide GDP. The decline reflects a striking slowdown in the economies of emerging markets like China; this slowdown was offset by strong consumer spending in the United States.

Growth in the U.S. specialty fabrics industry was about 2.4 percent in 2015, and is expected to reach 2.6 percent in 2016. That growth will depend on the continuation of a low unemployment rate between 5.0 and 5.5 percent, a continued increase in consumer spending above 2 percent and continued low oil prices.

Despite the improvements in the unemployment rate in 2015, consumers are still very cautious about spending. Still, we do expect to see a 2.7 percent increase in consumer spending in 2016, as people remain confident that the U.S. economy will continue to expand at a consistent, gradual pace.

Tent rental and manufacturing

This is a very competitive market. There are thousands of companies competing to rent tents and tent-related equipment to weddings, fairs and public and private events of all types. In terms of volume, sales for the U.S./Canadian manufacturer market were 23.2 million square yards in 2015, up 4 percent from 2014. Sales are projected to be 24.4 million square yards in 2016, up 5 percent from 2015.

The party and event rental market grew 6 percent in 2015 and is expected to grow by 7 percent in 2016. The corporate event market also improved in 2015; it’s estimated to have grown about 3 percent in 2015 and should reach 4 percent growth in 2016. The scope of corporate events saw a noticeable increase in 2015 as budgets expanded from the economies of the post-recession years.

Trends in tent rental

Key trends in the tent rental market in 2015:

Tent event customers are increasing their budgets for events; events have become larger and more complex; customers are spending more money for full floors and décor. As a result, event tent operators are carrying more staff and inventory.

There is more demand for tent sidewalls, liners and flooring. As a result, event operators continue to market their organizations as full-service event professionals; they sell the entire event offering—the tent itself, flooring, lighting and accessories.

Tents are becoming more user-friendly and easier to install.

Sailcloth tents are becoming more popular—especially in the fast-growing wedding market. They are visually appealing, with sculpted peaks and eaves that create an open-space feel at outdoor events.

For the second year in a row, clearspan tents have been growing; they are largely serving the demand for bigger, more complex events.

Government regulations and permitting are increasing; event operators are spending more time acquiring the proper permit so they’re in compliance with building codes.

Outlook for the tent rental and manufacturing market. During the last few years, tent event operators have done a better job of marketing their tent rental offerings to their customers; both corporate and party events grew in popularity in 2015. Customers are spending more money on larger events. In 2016, look for corporate and party events to attain their highest growth since the Great Recession in 2009.

Industry outlook

Leaders in the industry interviewed at IFAI Expo 2015 reported that they are somewhat optimistic about sales prospects for 2016. The feeling is that the economy is going to be better than it was in 2015—with more job growth, leading to greater consumer confidence and resulting in more consumer spending on specialty fabrics.

Increased sales in 2016 and beyond will be largely captured by those players in the specialty fabrics industry who have regularly invested in resources for developing innovative products, entering new markets and exploring ways to get closer to the customer—such as improving the logistics supply chain. Some of the developments market participants should see in 2016 include:

- Greater consumer demand overall for their products and services

- Relief from high raw material costs; oil prices will remain low at about $39 per barrel

- Losing sales to overseas competition may again ease a bit, as fabrics imported from countries like China should decrease as China struggles to stabilize its domestic economy

Industry participants who actively look for opportunities in the marketplace and take advantage of them will continue to separate themselves from competitors who continue to do business as usual. The successful players in the specialty fabrics industry already know they must continue to commit to investments: pushing the envelope in terms of developing and delivering innovative products every year, and reinventing the company’s overall business model every 5-10 years; and improving internal business processes such as the logistics supply chain and lean manufacturing techniques.

Key to the success of any company is to vigorously and continuously pursue meaningful ways to ensure that products and services are relevant and important to customers and potential customers. Successful market participants have committed to this mission by creating and delivering innovative products and employing marketing mediums, tactics and messages that truly connect with the customer, through trade shows, advertising and promotional offerings, public relations and community relations.

Jeffrey C. Rasmussen is IFAI’s market research director. Contact him at jcrasmussen@ifai.com, +1 651 225 6967.

TEXTILES.ORG

TEXTILES.ORG